For example, customer acquisition costs, which refer to acquiring new customers, can be useful for businesses looking to expand their customer base. Similarly, employee-related costs, such as salaries, benefits, and training expenses, can be tracked as a cost object to help businesses understand the true cost of their workforce. Businesses must clearly understand their costs as they strive to make informed financial decisions.

Who will typically control the indirect costs?

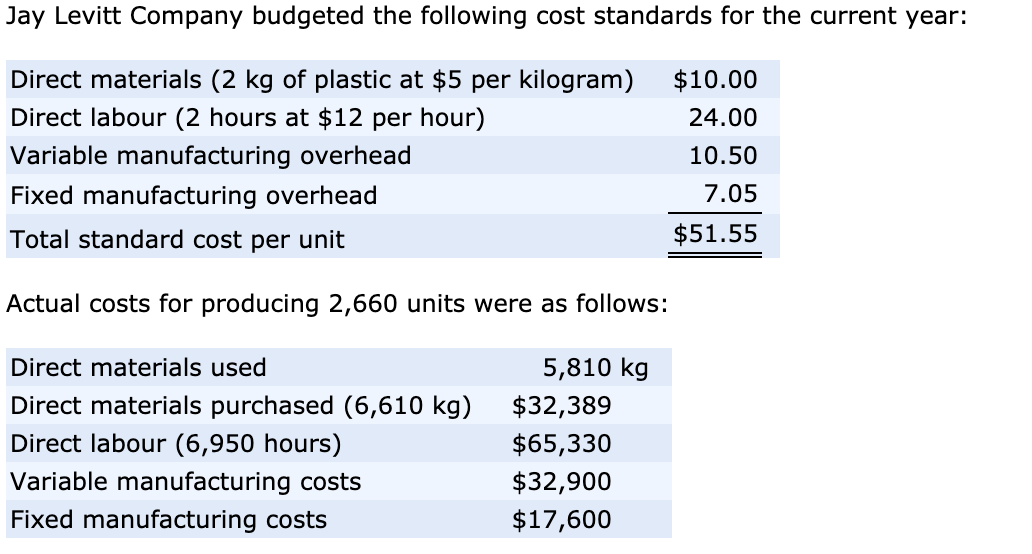

There is almost no limit to what you can identify as a cost object as long as you can find a way to assign costs to it. The most critical aspect of determining a cost object is the ability to allocate costs in order to get a complete picture to plan, make decisions, and perform controlling activities. Other direct costs for a product can include salaries for production employees, equipment purchased to produce the products, and maintenance done on assembly line. In the past, we believe that the fixed costs remain the same regardless of the business operation.

Direct Costs: Definition

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Cost objects can be used to track the cost of specific projects, such as new product development, process improvement, or facility upgrades.

- We will also discuss the benefits and challenges of using cost objects for decision making.

- Cost object management can help businesses to improve their decision making, budgeting, pricing, and performance evaluation.

- Understanding cost objects helps businesses figure out where they spend money and how to use resources better.

- Clear cost identification leads to better overall financial health for a company.

Direct Costs

However, achieving consistency can be challenging, mainly if the business uses different allocation methods or cost objects over time. Companies may need to implement procedures to ensure that cost allocation is consistent over time. Assigning costs to cost objects requires accuracy to ensure the resulting data is reliable and valuable.

Explanation: What Are Direct and Indirect Costs?

These costs refer to the money spent promoting or maintaining relationships with customers, suppliers, and other business partners. The division manager or department manager will typically have control over their direct costs. The cost of plastic used in production can be easily traced to the food containers. However, the cost spent for electricity is not directly traceable to the food containers since such cost was not used solely for the production of the product. Regular cost object monitoring and analysis can help a company optimize cost spend, identify efficiencies and streamline operations over time. This kind of cost should be separated into the income statement which helps management to make a decision.

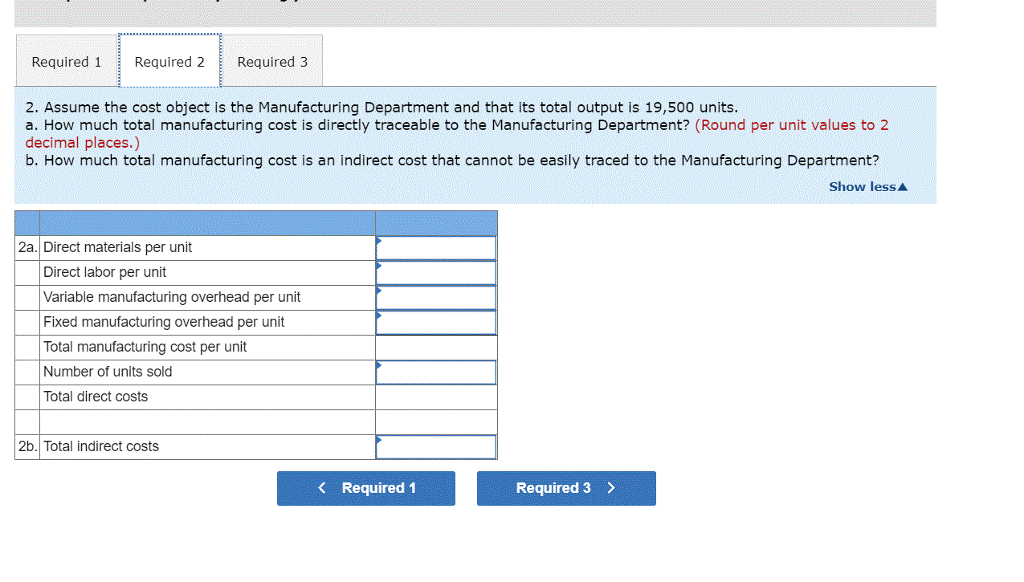

This can help them charge competitive and fair prices, and assess the profitability of each service or customer segment. The purpose of identifying cost objects is to assign costs to them in a systematic and logical manner. This helps managers to plan, control, and evaluate the performance of their activities. In this section, we will explore the concept of cost object in more detail and learn how to define and trace costs to a specific cost object.

To compare costs, it is necessary to know the cost objects related to the products or activities. It is also required to know which cost centre is related to the product or activity. It is also necessary to know the cost centre that is related to the product or activity that is being costed. By contrast, the manager will not have control over the portion of indirect costs. A critical piece of information for managers is the ratio of direct to indirect costs in the total cost.

The division manager or department manager will typically not have control over indirect costs. Examples of direct costs include direct materials, direct labor, and other costs incurred for a particular product such as advertising and promotion costs for, say “Product A”. Moving from the internal workings of operational cost objects, let’s consider business relationship cost objects. These include customers, contracts, and external partnerships that a company maintains. Working with a professional accountant can guide businesses on best practices for using cost objects. An experienced accountant can also help businesses identify areas for improvement and implement effective cost-management strategies.

Although direct costs are typically variable costs, they can also include fixed costs. Rent for a factory, for example, could be tied directly to the production facility. However, companies can sometimes tie fixed costs to the units produced in a particular facility. This can help them evaluate the costs and benefits of different alternatives, and choose the best option that maximizes the value for the organization.

Keeping up-to-date with industry publications, such as accounting and finance journals, can provide businesses with valuable insights and best practices for using cost objects. Subscribing to newsletters and following industry influencers on social media can also provide helpful information. Attending conferences and seminars related to accounting and finance can provide businesses what’s the difference between amortization and depreciation in accounting with the latest updates and best practices in cost object management. These events are also an excellent opportunity to network with other professionals in the field. Operations managers are responsible for overseeing the day-to-day operations of the organization. They may assign costs to cost objects related to operational expenses, such as supplies and equipment maintenance.