Both companies experienced improvement in liquidity moving from 20X2 to 20X3, however this trend reversed in 20X4. Our team is ready to learn about your business and guide you to the right solution. Current ratios can vary depending on industry, size of company, and economic conditions. Bankrate.com is an independent, advertising-supported publisher and comparison service.

How to Calculate the Current Ratio in Excel

In other words, “the quick ratio excludes inventory in its calculation, unlike the current ratio,” says Johnson. The current ratio describes the relationship between a company’s assets and liabilities. For example, a current ratio of 4 means the company could technically pay off its current liabilities four times over. Generally speaking, having a ratio between 1 and 3 is ideal, but certain industries or business models may operate perfectly fine with lower ratios. Within the current ratio, the assets and liabilities considered often have a timeframe.

Current Ratio vs. Quick Ratio: What is the Difference?

Conversely, industries such as technology and biotechnology tend to have lower current ratios. The current ratio has several limitations that could cause it to be misinterpreted. It is crucial to keep this in mind when using the current ratio for investment decisions. As noted earlier, variations in asset composition can cause the current ratio to be misleading. It’s the most conservative measure of liquidity and, therefore, the most reliable, industry-neutral method of calculating it.

Everything You Need To Master Financial Modeling

- You can find these numbers on a company’s balance sheet under total current assets and total current liabilities.

- A strong Current Ratio can instill confidence in potential investors, but it should be evaluated alongside other financial metrics and the company’s specific circumstances.

- While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

- However, similar to the example we used above, special circumstances can negatively affect the current ratio in a healthy company.

- Current assets refers to the sum of all assets that will be used or turned to cash in the next year.

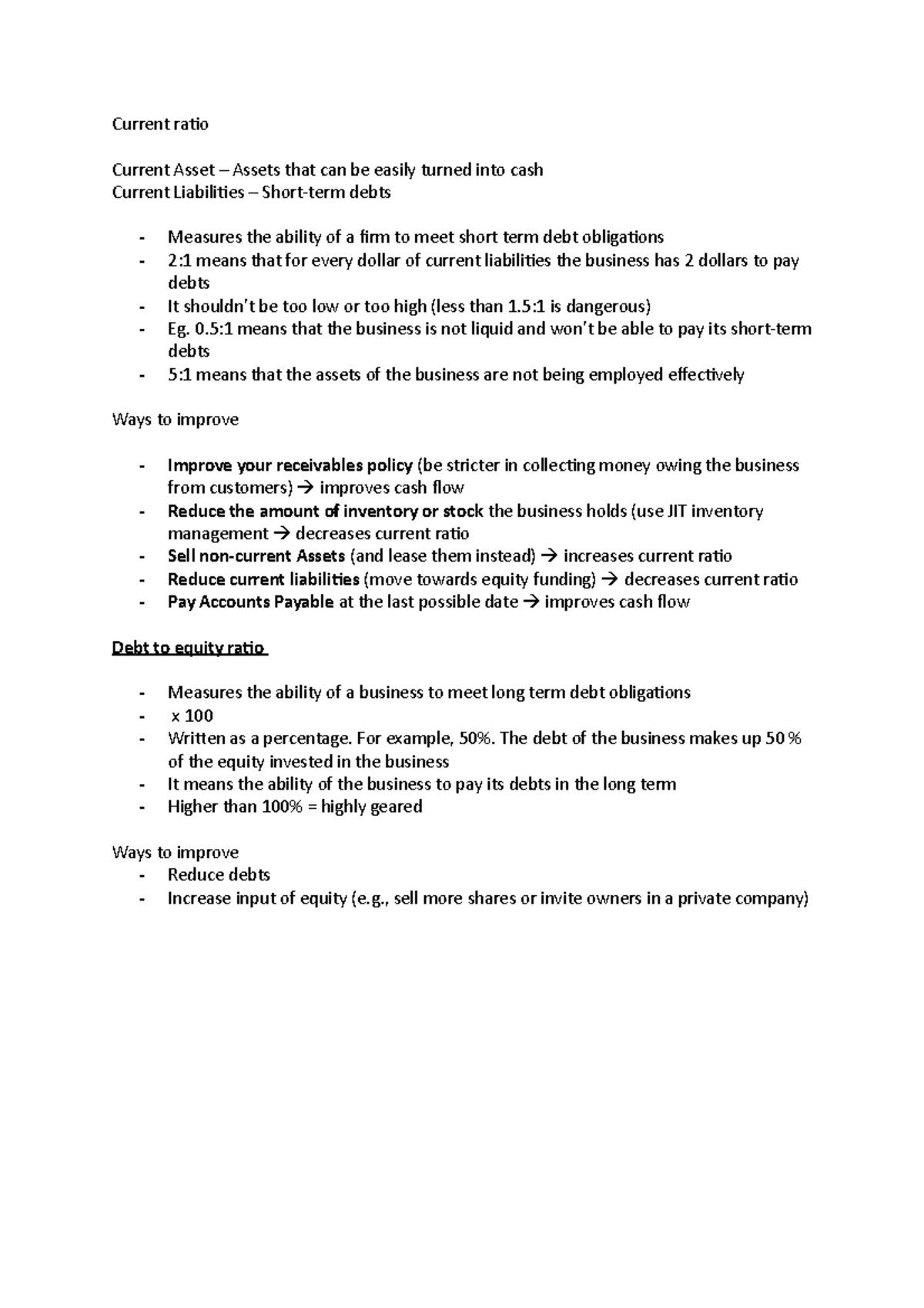

You’ll want to consider the current ratio if you’re investing in a company. When a company’s current ratio is relatively low, it’s a sign that the company may not be able to pay off its short-term debt when it comes due, which could hurt its credit ratings or even lead to bankruptcy. The current ratio is an evaluation of a company’s short-term liquidity.

To Ensure One Vote Per Person, Please Include the Following Info

The company has just enough current assets to pay off its liabilities on its balance sheet. There are no specific regulatory requirements for the value of the current ratio in the US or EU. However, regulators may consider a company’s current ratio as part of a broader evaluation of its financial health.

Balance Sheet Assumptions

In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000). Further, two companies may have the same current ratios but vastly different liquidity positions, for example, when one company has a large amount of obsolete inventories. A more meaningful liquidity analysis can be conducted by calculating the quick ratio (also called acid-test ratio) and cash ratio. These ratios 5 tax breaks for first time homebuyers remove the illiquid current assets such as prepayments and inventories from the numerator and are a better indicator of very liquid assets. Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows.

Although the total value of current assets matches, Company B is in a more liquid, solvent position. Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash in less than one year. A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its cash or other short-term assets expected to be converted to cash within a year or less. In general, the higher the current ratio, the more capable a company is of paying its obligations because it has a larger proportion of short-term asset value relative to the value of its short-term liabilities. Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected. Commonly acceptable current ratio is 2; it’s a comfortable financial position for most enterprises.

Business owners and the financial team within a company may use the current ratio to get an idea of their business’s financial well-being. Accountants also often use this ratio since accounting deals closely with reporting assets and liabilities on financial statements. If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. Sometimes this is the result of poor collections of accounts receivable.

Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s. This is once again in line with the current ratio from 2021, indicating that the lower ratio of 2022 was a short-term phenomenon. The increase in inventory could stem from reduced customer demand, which directly causes the inventory on hand to increase — which can be good for raising debt financing (i.e. more collateral), but a potential red flag. These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

The current ratio evaluates a company’s ability to pay its short-term liabilities with its current assets. The quick ratio measures a company’s liquidity based only on assets that can be converted to cash within 90 days or less. It is important to note that a similar ratio, the quick ratio, also compares a company’s liquid assets to current liabilities. However, the quick ratio excludes prepaid expenses and inventory from the assets category because these can’t be liquified as easily as cash or stocks. The current ratio is balance-sheet financial performance measure of company liquidity. The current ratio indicates a company’s ability to meet short-term debt obligations.

Since it reveals nothing in respect of the assets’ quality, it is often regarded as crued ratio. On December 31, 2016, the balance sheet of Marshal company shows the total current assets of $1,100,000 and the total current liabilities of $400,000. What counts as a good current ratio will depend on the company’s industry and historical performance. Current ratios over 1.00 indicate that a company’s current assets are greater than its current liabilities, meaning it could more easily pay of short-term debts. A current ratio of 1.50 or greater would generally indicate ample liquidity.