Moreover, features like real-time reporting and analytics allow finance teams to quickly adapt to changing business needs and make more informed decisions, enhancing their agility and responsiveness. “Accounts Payable” refers to money a company owes its vendors for goods or services they purchased on credit. Teams record these liabilities, which represent short-term debt the company will pay over a specific period, in the general ledger.

- By identifying and collecting diversity information from current supplier relationships, businesses can examine and improve their diversity numbers across all accounts.

- They impact cash flow management, as longer payment terms give a company more time to use its cash for other purposes before paying its bills.

- Confirm any and all payments in your accounts payable system are correctly recorded by cross-checking them against the entries in your bank statements to make sure they match.

- This helps to ensure that it positively contributes to the working capital management of the company.

- There are various softwares and systems that are designed to maintain the accounts payable general ledger record so that the entire process is streamlined to provide valuable insight into the system.

Why is the accounts payable process important?

I review the payment status in our accounting system and provide the vendor with an update, including the expected payment date if the payment is still pending. If there are any issues or discrepancies, I work with the relevant internal departments to resolve them quickly. Keeping clear records of all communications helps ensure that inquiries are handled efficiently and professionally. Handling partial payments to vendors requires clear communication and accurate record-keeping. When a partial payment is necessary, I first ensure that the reason for the partial payment is documented, such as a dispute over part of the invoice or a cash flow issue. I communicate with the vendor to explain the situation and agree on the partial payment amount and schedule for the remaining balance.

Ready to Transform Your Accounts Payable Process?

This not only helps in maintaining good vendor relationships but also in optimizing cash flow management, thereby contributing to the overall financial health of the company. By comparing the balances between these two accounts, businesses can identify any discrepancies or errors that need to be resolved. This process helps ensure the accuracy of financial statements can you explain how you approach working with ledgers in accounts payable and provides a clear picture of the company’s financial position. Additionally, regular reconciliation can help identify any duplicate payments, unrecorded liabilities, or other anomalies that may require further investigation. Year-end 1099 forms are essential to maintaining accurate financial records and ensuring compliance with tax regulations.

Pay your team

I perform a thorough review and reconciliation of all accounts payable ledgers, matching the subsidiary ledger with the general ledger. Effective vendor management is essential for optimizing accounts payable processes. By establishing strong relationships with suppliers, businesses can negotiate better payment terms, discounts, or even volume-based pricing. Keeping track of payment deadlines across numerous invoices and ensuring timely payments can be a complex task. Late payments can result in penalties, damage vendor relationships, and negatively impact credit terms.

Accounts Payable Ledger

With automated accounts payable, you gain real-time insights into your financial status. You can easily track pending invoices, payment statuses, and overall cash flow, allowing you to make informed decisions quickly. Automation ensures that data is accurately captured and processed, minimizing mistakes that can occur with manual handling. Business owners must monitor the accounts payable balance and use a cash forecast to plan the payments. A company’s cash position is important because every firm needs a minimum cash balance to operate. Owners must consider the timing of cash inflows from accounts receivable and the cash outflows required for accounts payable.

What are the Best Practices to Know for Accounts Payables?

While in reality, there is a strong need to adequately manage and monitor the payable management process. The accounts payable process plays an important role in your business’s accounting operations for several reasons. There are many moving parts to keep track of when taking care of your business’s accounting, and the accounts payable process is one of the most important.

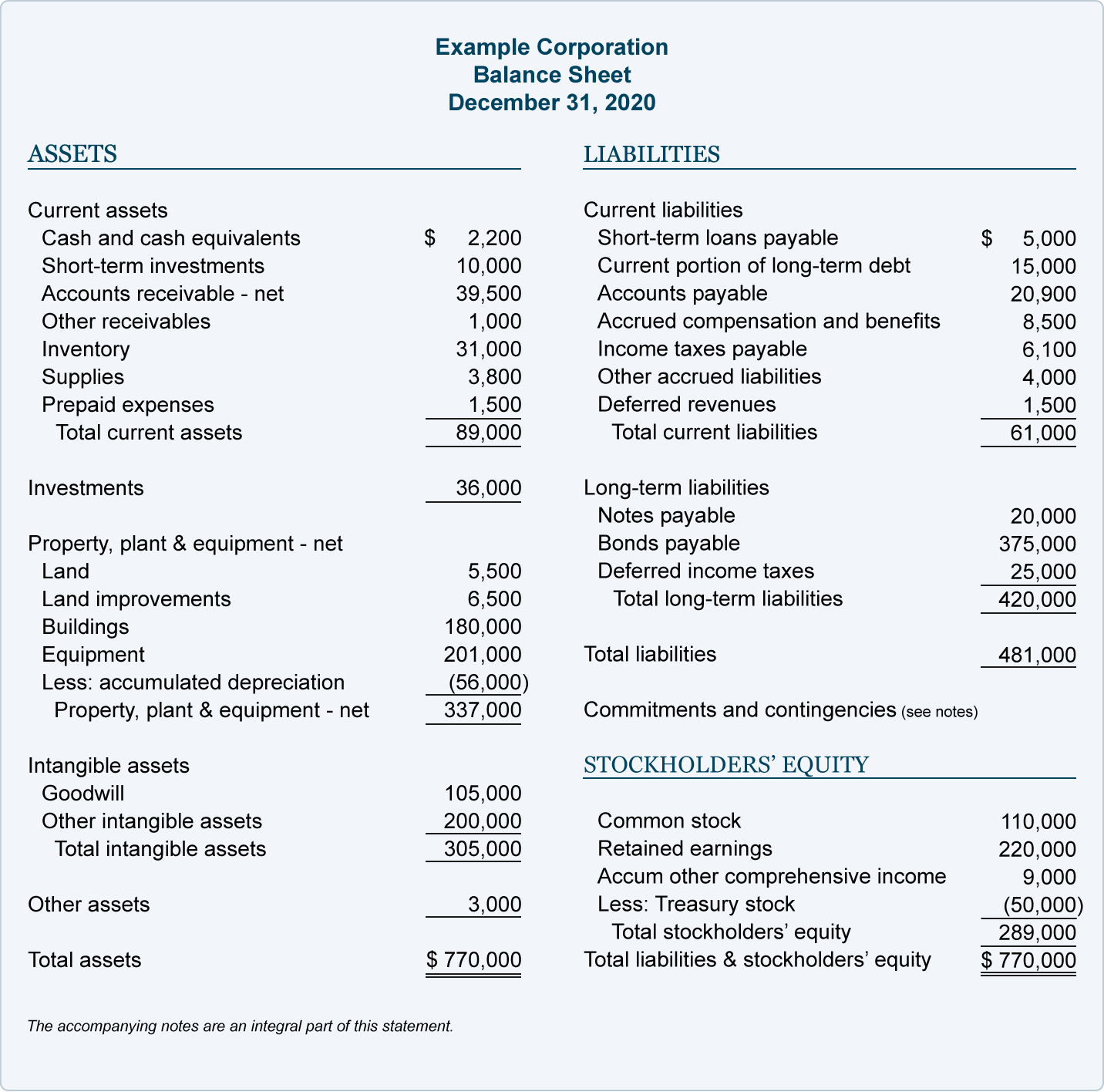

It compares your internal cash records against your bank’s records for that account, with the aim of explaining the differences between your bank statement balance and your ledger cash balance. Many things contribute to your small business’s success, but effectively managing cash flow is critical. Adding in the accounts payable process is necessary for effective business accounting, but we know it can be time-consuming. Accounts payable, also known as AP, are the total debts that you owe to other businesses for products and services that they invoiced you for. Your company’s accounts payable debts are found within the current liabilities section of your balance sheet. These amounts are treated as short-term debts, rather than long-term debts, like a business loan.

Recorded on the balance sheet under current liabilities, AP is a critical part of a company’s working capital management. This liability arises when a company receives goods or services before payment is made, reflecting a company’s use of credit as a financial strategy. First, I ensure that we have accurate and complete tax identification information for all vendors who require 1099 reporting. Throughout the year, I track payments to these vendors, ensuring they are correctly categorized for 1099 purposes. At year-end, I generate and review the 1099 reports, checking for accuracy and completeness. They also affect vendor relationships; adhering to agreed-upon payment terms helps maintain trust and reliability.

For example, if a purchase of equipment on account were not paid for by the end of the fiscal year, the balance of the equipment account would be a debit in the accounts payable ledger. This would mean that the creditor who supplied the equipment would have a negative balance in the accounts payable ledger. A great accounts payable team uses tech to cut down on errors, reduce processing times, and run an efficient operation. A good accounts payable team will use an accounts payable ledger to stay on top of their invoices. Regularly checking your accounts payable ledger helps you stay on top of your outstanding amounts so you’re never missing an invoice payment.